Geolocation for the insurance sector: a Woosmap talks with Mathilde Lemaire

The insurance sector needs to strengthen its resilience and capacity for innovation, in the face of economic, technological and environmental change. Data is at the heart of these risk management and innovation strategies. In particular, data from mapping and geolocation APIs. Mathilde Lemaire, Territory Manager Benelux & Nordics at Woosmap, talks about relevant geolocation use cases in the insurance sector. What’s at stake: improving customer relations, reducing costs and strengthening the security of personal data.

How is the insurance sector using geolocation?

Many players in the insurance and financial services sectors are already incorporating geolocation into their commercial strategies. Woosmap's insurance customers include Allianz, Axa, Maif, Covea, Direct Line, SegurCaixa Adeslas and Yuzzu.

The classic use cases for geolocation in insurance are similar to those in e-commerce. For example, store locators can also be used to create “agency locators” to help customers find an insurance agency in their geographical area.

Insurers' marketing teams can also build geolocalised campaigns for different customer segments. This geographical personalisation of marketing messages is particularly relevant for home and car insurance. Geolocation can also provide data for tailoring insurance products to user behaviour. Some insurers are already offering pay-as-you-go or distance-based payment models with geofencing technologies (virtual zoning to activate services).

Finally, let's not forget the impact of geolocation "behind the scenes". Because it is helping to improve the operational efficiency of insurers and their customer relations. For example, geolocation in call centres can help operators enter an address more quickly, using autocompletion.

Talking about customer relations in the insurance industry, what impact can mapping and geolocation have?

With increased competition, “insurtech” new entrants and more volatile customers, customer retention continues to fall steadily in the insurance sector. The annual rate of insurance contract renewal exceeds 15% in many major OECD countries. (24.5% in Belgium, 19.1% in the United Kingdom, 18.7% in the United States, 16% in Germany and 14.3% in France. According to OECD figures for 2021).

To acquire and retain customers, insurers need to be able to differentiate themselves on more than just price. That's why the insurance industry needs to offer new services. And simplify the contact process for their customers. Geolocation is one of the solutions that simplifies this contact. It helps to increase customer "lifetime value" by supporting loyalty strategies and the sale of additional services. The integration of mapping and geolocation into insurers' mobile applications and call centres is delivering tangible ROI.

What role do call centres play in insurers' customer relations?

Today, 50% of customers prefer to buy insurance via an insurer's website. And 40% use the website of a comparison shopping engine or aggregator. But the call centre remains a crucial tool in the strategies of insurance players, both as a sales tool and as an after-sales contact channel.

Customers want to be able to use different communication channels depending on the time of day or the type of information they are looking for. In fact, 75% of customers say they would switch to another insurer if they did not have access to an insurance service that was seamlessly accessible across all channels. (Cap Gemini World Insurance Report 2020).

Faced with these omnichannel or even 100% digital customer journeys, insurers are increasingly developing selfcare tools. These allow customers to complete online procedures using contact forms or chatbot assistance. But the voice channel remains an important part of the relationship of trust between the insurer and its customer. Particularly when signing a policy or making a claim.

Moreover, when associating selfcare tools, geolocation and AI, it brings automation into the equation. By automating part of the call centre's work, some costs can be optimised as well as the ROI of the insurance's experts.

How can insurance call centres use geolocation?

Geolocation allows call centre operators to save precious seconds when filling in contact fields and avoid typing errors address autocompletion. Speeding up this stage of the customer journey reduces the average time taken to process requests (for insurance policy quotes, claims, etc.). This helps to reduce the cost per contact and increase customer satisfaction.

Filling in address fields can even be fully automated if customers have authorised their insurer's application to geolocate them. What's more, using geographical information, insurance agents can identify additional sales opportunities. In home insurance, for example. To offer additional cover to a customer living in a flood zone or exposed to other environmental risks.

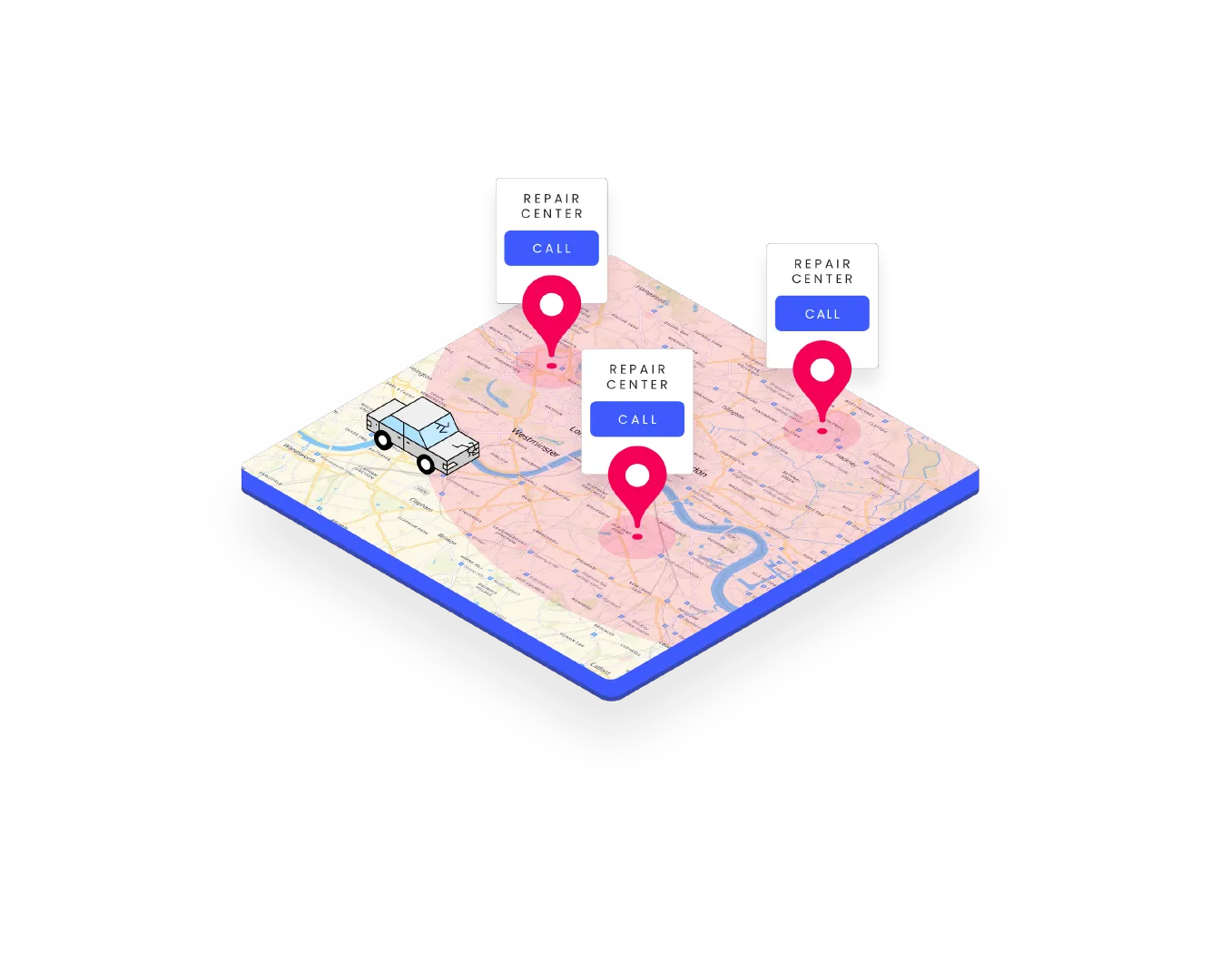

Finally, in the event of a car breakdown or accident, the primary role of geolocation is to ensure the protection of policyholders by triggering the dispatch of assistance services. For example, to dispatch a tow truck or an approved repairer who is available nearby, with an estimated time of arrival. This enables call centres to assist policyholders more quickly.

They can also play a role in preventing incidents, with advice tailored to the location of customers. This prevention work also uses geolocation data to better model risks and their evolution. For example, the risk of fire or flooding.

What advantages can "locators" bring to insurance networks? What services can insurers offer using geolocation?

The address is a key information for insurtech, as it determines the user's risk profile at the start of the customer journey. Entering personal data, usually in several forms, about the address of the home or property to be insured is therefore an important part of the user experience. And it can be improved with a locator: an address and postcode finder.

Users type the beginning of their address and are immediately presented with a list of suggestions that are consistent with their location. This not only saves a lot of time in the digital journey, but also provides insurers with a guarantee on the quality of the data they receive from customers.

But let's also take a look at the use case of locating the nearest agency. Today's e-tailers and insurers need to build phygital strategies, combining digital uses and physical points of presence.

This is why insurers are now transforming their agencies to make them more welcoming and more experiential. Some are creating areas dedicated to comforting customers after a claim. Or collaborative areas where customers can work together with their insurance advisor to draw up a quote on a tablet. The insurer Generali has even tested the use of augmented reality headsets in its agencies to raise customers' awareness of road risks.

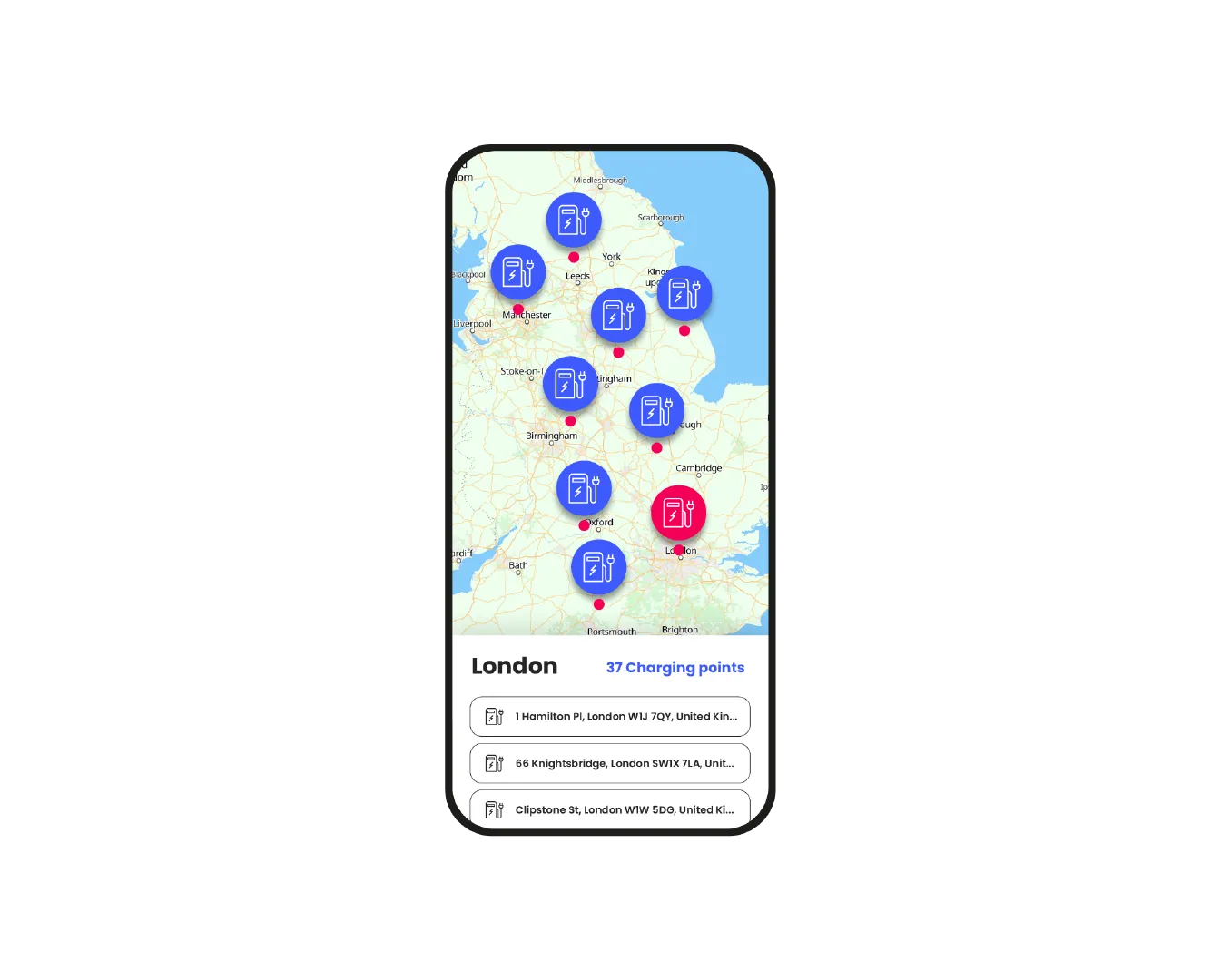

Dynamic mapping with "store locators" makes it possible to enhance the local, national and international coverage of an insurance agency network. Customers also need clear information about opening times, so that they can plan their visit around their other travel arrangements. Services such as recharging points for electric vehicles have also become a key differentiator when they are supported by a Services Locator. The Woosmap geolocation API makes it easy for insurers to manage the uploading and updating of information on opening times and the services available in the agency. Woosmap is interconnected with hundreds of local and international data providers, enabling our customers to display information relevant to their business.

When it comes to environmental issues, how can Woosmap help insurers offer new services for eco-conscious customers?

Insurers are already anticipating environmental risks and adapting to the changing expectations of more eco-conscious customers. Some insurers are offering reduced insurance policies for homes that have been renovated to improve their energy performance. Insurers can also support the transition to electric vehicles with tailored insurance policies and new services. For example, by offering up-to-date, real-time information on the location and availability of electric vehicle charging points.

This is what a major British insurer is offering. It is integrating Woosmap mapping into an online portal to help drivers make the transition to an electric world. Available since 2022, this one-stop shop offers everything. From hiring a vehicle to buying a home charger and choosing insurance for your electric car. It's also an example of the type of services that insurers can now offer their customers to stand out from the crowd and win their loyalty.